Ryan Watson was inspired to start his own wealth management firm, Tribeca, in December 2010 when he saw the amount of opportunity available in financial planning at the time. “Advice was reasonably narrow and product centric,” Watson reflects, “it was clear to me that the Australian consumer wanted more comprehensive holistic advice”. With this in mind, Tribeca’s brand promise, ‘My Good Life’, was made which aims to uncover the client’s short, medium and long-term goals and demonstrate value in each of these areas, for example by minimising tax, creating strong returns and monitoring cashflow with structure.

Fast forward 11 years, Tribeca now looks after 800 families, has grown to 20 staff which includes 7 financial advisors and is about to hire another 2 advisers. Ryan sees an abundance of opportunity for financial planners, “Plenty of people want good advice and we have seen strong growth year on year,” he says. The main source of new client business comes from trusted introductions from an existing client, followed by referral partners such as accountants, solicitors, mortgage brokers and of course, marketing. Ryan states, “Our mission is to build a true financial wellbeing practice”.

Tribeca uses a Financial Planning wellbeing matrix that has a mix of traditional components of advice which help with outcomes such as security and freedom of choice. The team pride themselves on building strong trustworthy relationships with clients to ask the deeper questions that perhaps other firms struggle with.

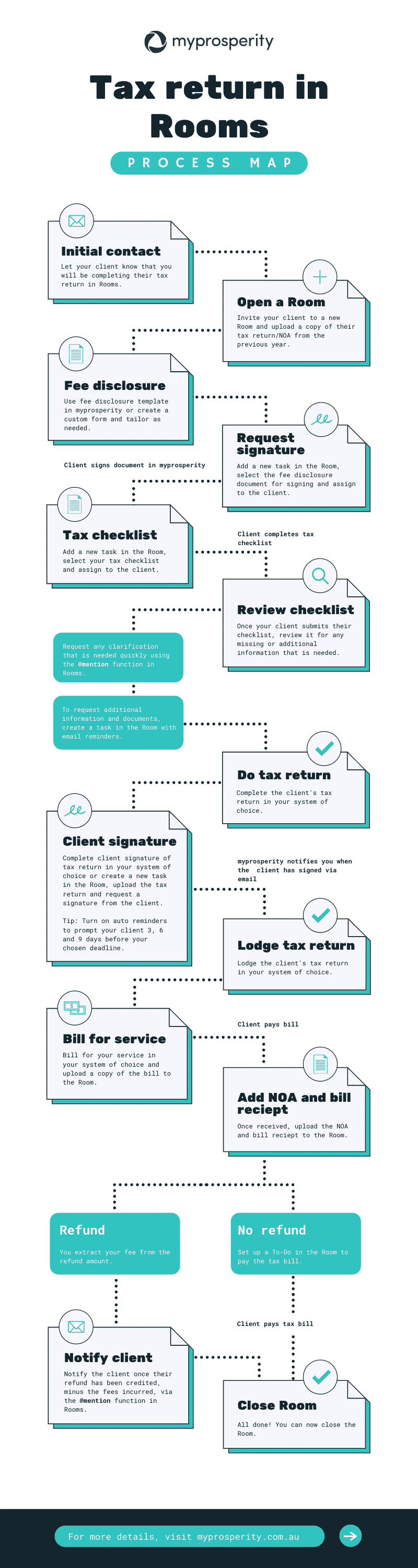

With any new client meeting, the adviser will assess if there is qualitative and quantitative alignment and if so it will progress to the discovery meeting, where the Tribeca wealth portal is introduced for them to fill out the initial digital fact find within 48 hours. This is where the client journey starts because having information and linking up accounts is a solid foundation to servicing clients in an efficient manner. Throughout the journey there are touchpoints such as getting clients to sign a document, sending them a push notification, storing documents and goal tracking.

“We see the value in occupying that real estate on the client’s phone, hence we make sure every single household has the Tribeca app downloaded on their smartphone and tablet”. With existing clients, Ryan mentions the fully engaged advisers strategically introduced their clients to the portal and app over the course of the year. Tribeca sees the return on the investment in a client portal because all of their clients’ data is linked and it’s a vital part of their preparation for quarterly, half yearly and annual planning meetings with clients.

More so than ever, advisers are challenged by compliance pressures which make them more inefficient, so being armed with information and not having to ask clients every time is extremely valuable. Ryan and the team can also foresee opportunities so that they can add quantitative and qualitative value for their clients. “Having access to assets, liabilities, income and expenditure solved our problem. As we continue to move forward, client experience is key so any friction advisers can remove enhances the experience”.

Interested in your own branded wealth portal?

Recent Comments