This month, we continue our WoWcrowd series with another brilliant episode, and leading the charge is arguably Australia’s most recognisable business woman, Janine Allis. Not only does Janine have an incredible success story with Boost Juice, she’s also a bestselling author, investor on Channel TEN’s ‘Shark Tank’, and has been named in BRW’s top 15 people who have changed the way business is done in the last 25 years. Janine Allis is a force to be reckoned with, and we were extremely thrilled to have her share her fascinating experiences on our latest WoWcrowd episode, ‘Boost your business performance.’

Beginning her story of growing up in Ferntree Gully, Victoria playing netball every chance she got, Janine knew she was made for something off the beaten trail. “I was never that entrepreneurial, I was never that person that sold lemonade at a lemonade stand… but I was an adventurer,” said Janine, when asked about her childhood. “At 21, I worked all sorts of jobs just to earn enough money to travel,” she says, casually mentioning the few years she spent in the South of France working on David Bowie’s yacht. It’s the extraordinary start to her adult life that Janine attributes to her first lessons in business. “First, is that there’s always a solution to a problem. And the second thing, living and working with rockstars on David Bowie’s boat, is that people are people. Years later, when I was thrown into the world of business, I never felt better or worse than anyone else in the room. I told myself, I’ve got a lot to learn. The person in front of me can teach me. I’m sure that everyone I have a meeting with can teach me something.” This mindset allowed Janine to never underestimate her own value, and served her well when it came to persevering with Boost.

When Janine founded Boost Juice in 2000, she admits her naivety may have set her back along her journey, but it also allowed her to learn important lessons. “Failing wasn’t an option. Naivety and the ability to learn played an important part. I was like a sponge.” She also remembers her fear of failure being an enormous motivator for her in those early days, however, her self belief and unrelentlessly positive outlook propelled her forwards. “I found some of my advisers were horrific in the early days. If you looked at my accounts back then, my focus was on getting more money in than out. I didn’t have any understanding of accounting, however, I made sure I did the accounts from the start. I then finally passed it on to a financial controller who completely stuffed it up.” Janine then approached a top accounting firm that charged her for outcomes she never saw. “I found that there were a lot of people out there who didn’t understand what it was like to run a business,” she reflects, highlighting the need for advisers that are on the same page as their clients. “I’ve now come across some really dynamic, forward-thinking advisers. Your answers can be with those accountants and advisers who really stop to understand the business.”

When looking for a new adviser, Janine’s approach is simple – are they innovation-led and willing to try new and better approaches? She wants to know that they are continually improving, not using the same stock-standard advice that just won’t cut it for her business. She mentions her new accountant’s approach, who said “Here are the latest systems you can use to make your life as automated as possible.” Janine talked about her experiences with tech and automation in her business when it first arrived, “I was an early adopter of tech. I wanted to make my life as efficient as possible.” This was especially important for her as she was raising three children under the age of 3 and needed all the time she could salvage to focus on her business. “With tech, back then it was always over promise, under deliver – all the time! Despite the fact that it had all these promises, it’s only now in the last 5 years, that the tech is truly doing what it’s saying it’s going to do. Compared to what it was like 20 years ago when I started the business and trying to increase efficiencies, we’re now truly seeing efficiencies in tech.”

Following our chat with Janine, we invited a panel of experts in financial services to share their perspectives and reflections on Janine’s experiences. Joining us from Sayers Wealth, we were thrilled to have Chief Brand Officer, Kate Keenan alongside BlueRock Accounting Managing Director, Trevor Gordijn and ChangeGPS CEO, David Boyar. Kicking off the panel, the topic of taking on start-up and entrepreneurial clients was discussed. David weighed in saying “Startup clients and high-growth clients are fantastic. They’re also unscalable, unbelievably demanding and require top-of-the-tree expertise. It’s very rare that advisers can take on too many of those clients. It’s as much about where you are, how good your practice’s internal processes and service standards are, as it is about backing the grit of the individual client.” This focus on streamlining internal processes will naturally prepare advisers to take on those more challenging clients.

Janine mentioned her main motivators of fear and naivety when she first began on her venture to build Boost Juice, which is rooted in a sense of grit and perseverance she had developed as guiding characteristics in her earlier life. Trevor Gordijn elaborated on this point when it comes to boosting your business performance as an adviser or accountant and the importance of identifying your own core values. “Just be really clear on your purpose and why you’re doing what you’re doing and your belief system. I think that helps guide the type of work you do and who you want to work with. If you can connect those things and you’ve got the passion and commitment to do it, you will boost performance naturally.”

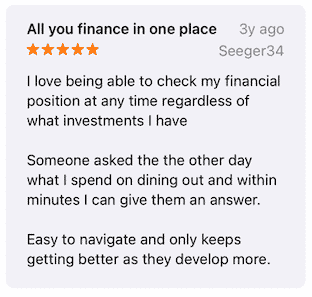

Janine shared her experiences finding the right accountant and financial adviser for her business, mentioning the importance of a keen disposition for innovation and growth; “Is there a better way? I will find it.” Elaborating on this, Kate drew on the importance of getting to know clients, especially how they prefer to engage with their adviser. “Having that whole-of-wealth view on the one platform is really powerful. Clients want to be able to track their finances using their phone, so they can see exactly where they are at any point in time across their whole portfolio.” She continued, adding on to Trevor’s comments on finding your own purpose, “You need to understand your client’s purpose too. You’re not there to say, ‘Here are our products, I think this one best fits you.’ Really try to sit in their seat and think ‘If I was you, is this the product I would want?’” This emphasis lay in knowing your own values, truly understanding your clients’ needs, and where they align. This helps to guide you in implementing the right tools and processes that will boost your business performance, and build solid relationships with clients like Janine, who seek out advisers who ‘get’ their business.

This was an awesome episode with some great ‘wow’ moments and valuable takeaways on defining your guiding principles, entrepreneurial clients and boosting business performance to get ahead of the crowd. If you missed out, you can watch the full episode here and don’t forget to register your interest for the next star-studded keynote and panel discussion for advisers and accountants here.

Author: Lauren Main

Recent Comments