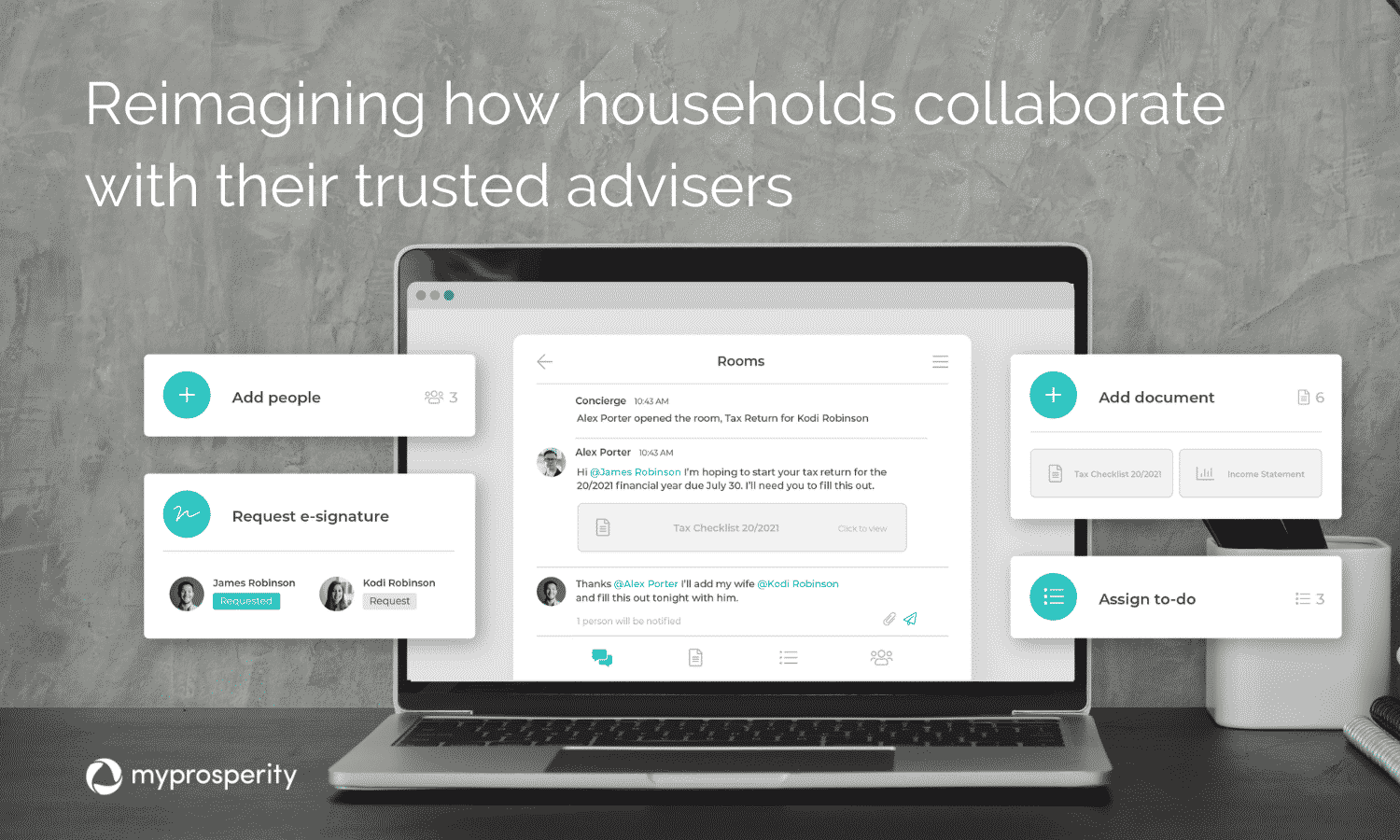

myprosperity launches secure tech platform to reimagine how households collaborate with their trusted advisers

Melbourne, Australia, October 14, 2021 – Financial services platform myprosperity has today launched its latest development that reimagines how households engage with their trusted financial professionals.

A recent CPA report revealed a $638B cost to the Australian economy where households are falling short due to a lack of access to the right advice. This problem has fuelled the development of myprosperity’s collaborative, digital solution: Rooms. The new platform helps Australian households and businesses access the financial products and services they need, when they need them by connecting them with the right accountants, advisers and other financial professionals.

myprosperity has already established integrations with other leading platforms including Xero, FYI, BGL, Xplan and Midwinter. Early adopters of the Rooms beta platform have reported a significant improvement in their client engagement, with myprosperity’s mobile-first approach making it easier than ever to access their financial world and discover new services.

Rooms is a place where advisers can collaborate directly with clients and get the job done all in one place. This provides an amazing client experience without the back-and-forth emails. It also includes myprosperity’s digital form technology so information can be captured, stored and shared securely. With world-class digital signature capability, you can upload documents in seconds, as well as set and allocate tasks and reminders so financial professionals can get the job done faster.

Powered by live data feeds, the platform creates better practice efficiencies and uncovers valuable insights and opportunities for advisers looking to enhance their clients’ financial world.

Commenting on the launch, myprosperity Founder and CEO Peter McCarthy said: “The financial services industry has always been about helping clients achieve their financial goals. myprosperity empowers our partners to do just this, and Rooms is the platform that will revolutionise how trusted advisers and their clients work together to achieve the best outcome.”

“Collaborating with clients in one place to work on specific jobs like tax returns, financial planning and loans creates efficiencies for our team and is a win for data security and client experience,” Daniel Stefanetti, Director of Grimsey Accountants and Advisors said.

myprosperity now connects over 55,000 households with financial professionals. Since the beginning of 2021, the platform has seen more than a 100% increase in logins with more accountants and advisors using the technology as a way to manage their remote workflow. From the start of the year there has been a 300% increase in digital forms created, a 400% increase in documents stored on the secure platform and a 250% increase in documents signed using myprosperity.

About myprosperity

myprosperity is an award-winning software company that provides a revolutionary platform for clients to come together with their accountants and financial advisers to help them live their best financial life. Founded in 2011, myprosperity combines cutting-edge technology with an extensive array of integrations to allow trusted advisers and their clients to collaborate all in one place. The company is now a leading private wealth platform in Australia, tracking more than $97B in assets and $17B in liabilities.

Recent Comments