I had the pleasure to chat with Prashant Nagarajan from Finnacle about how he built his practice, his vision and ultimately leveraging technology to drive efficiencies and make advice accessible for his clients.

Prashant and Finnacle co-Founder Daniel Thompson started their journey together back in 2012 when they were both working for ANZ. As they climbed the corporate ladder and dealt with more complex clients, they realised that most of the people that were reaching out to them were over the age of 60 and wanting to know how their money could stretch for them to retire in two to three years. After four years of the same conversations day in day out, predominantly discussing retirement plans, Prashant felt his job was becoming quite mundane. “I felt my job was becoming a one-trick pony,” he reflected, “there was a clear pattern here, these people should have reached out to us 20 to 30 years ago!”

As Prashant started to think about the younger demographic of 30-year-olds, it was clear that price was a barrier. Interestingly, during the same time, Prashant was about to purchase his first property and found that the opinions of the mortgage brokers, real estate agents and his friends were all varied and confusing. He realised that this is exactly the same problem most 30-year-olds are having.

Prashant started researching and surveying what aspirations 25 to 45-year-olds had and it was predominantly in buying their first home or investment property. Prashant ended up leaving ANZ and joining a financial planning company to learn how to weave property and financial planning concepts together. After two years, in late 2017 Prashant started his new practice, Finnacle. “I had an intuition, it’s now or never”.

The first 12 months were challenging, as Prashant spent a lot of his time surveying the younger demographic in what they actually wanted. There was no concrete data on this previously, so it was not surprising that he uncovered 95% of 25 to 45-year-olds did not have a clear understanding of what financial planners do. Most of the surveys uncovered the pain points around purchasing an investment property or starting a family. No one at all mentioned super or insurances, all the traditional aspects of financial planning. The next challenge was to consider different price points and after much trial and error, Prashant found the sweet spot subscription fee model that works well for his business and the younger demographic.

In the first year of the business, Prashant used paid advertising via Facebook to target his audience. “We wanted to fail fast if it didn’t work, but luckily for us, it did bring in the lead generation,” says Prashant. After the first two years, he was able to switch off the paid advertising and grow his team to six. “The business has really grown in the last 12 months. Time is the initial investment that you need to make to see a return on investment”.

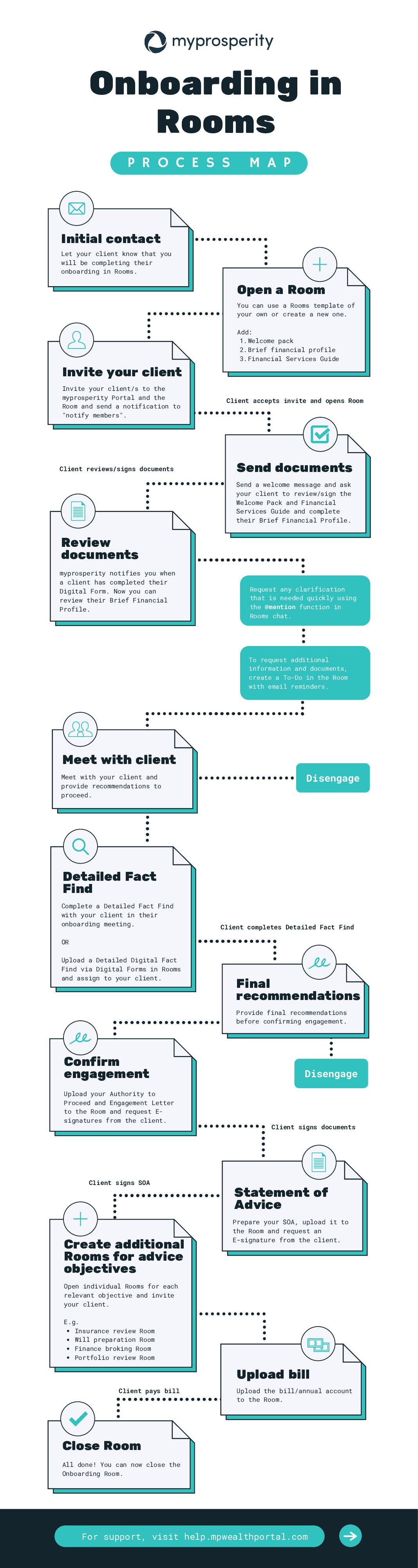

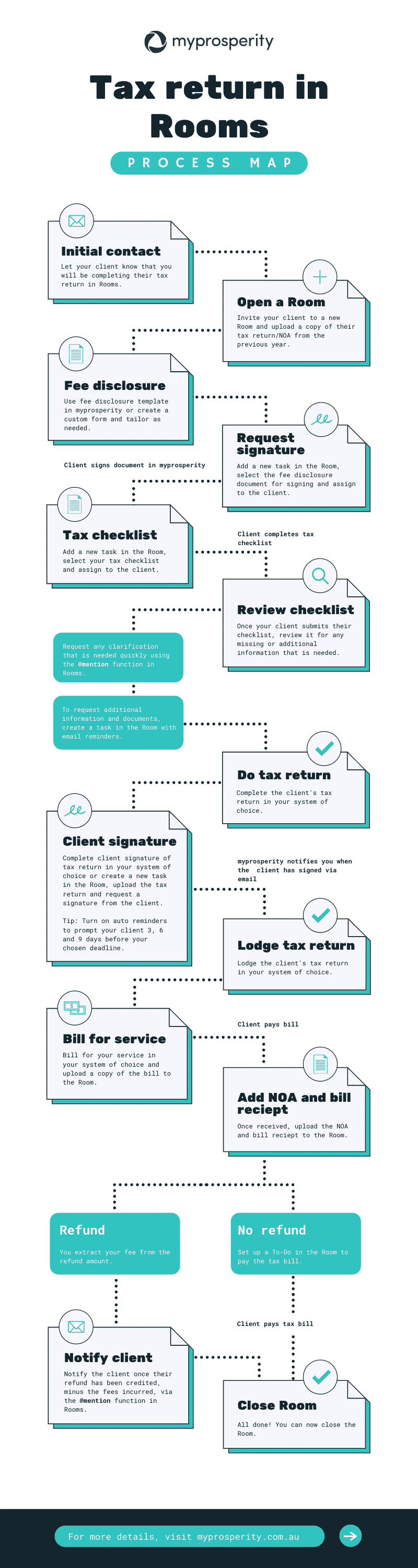

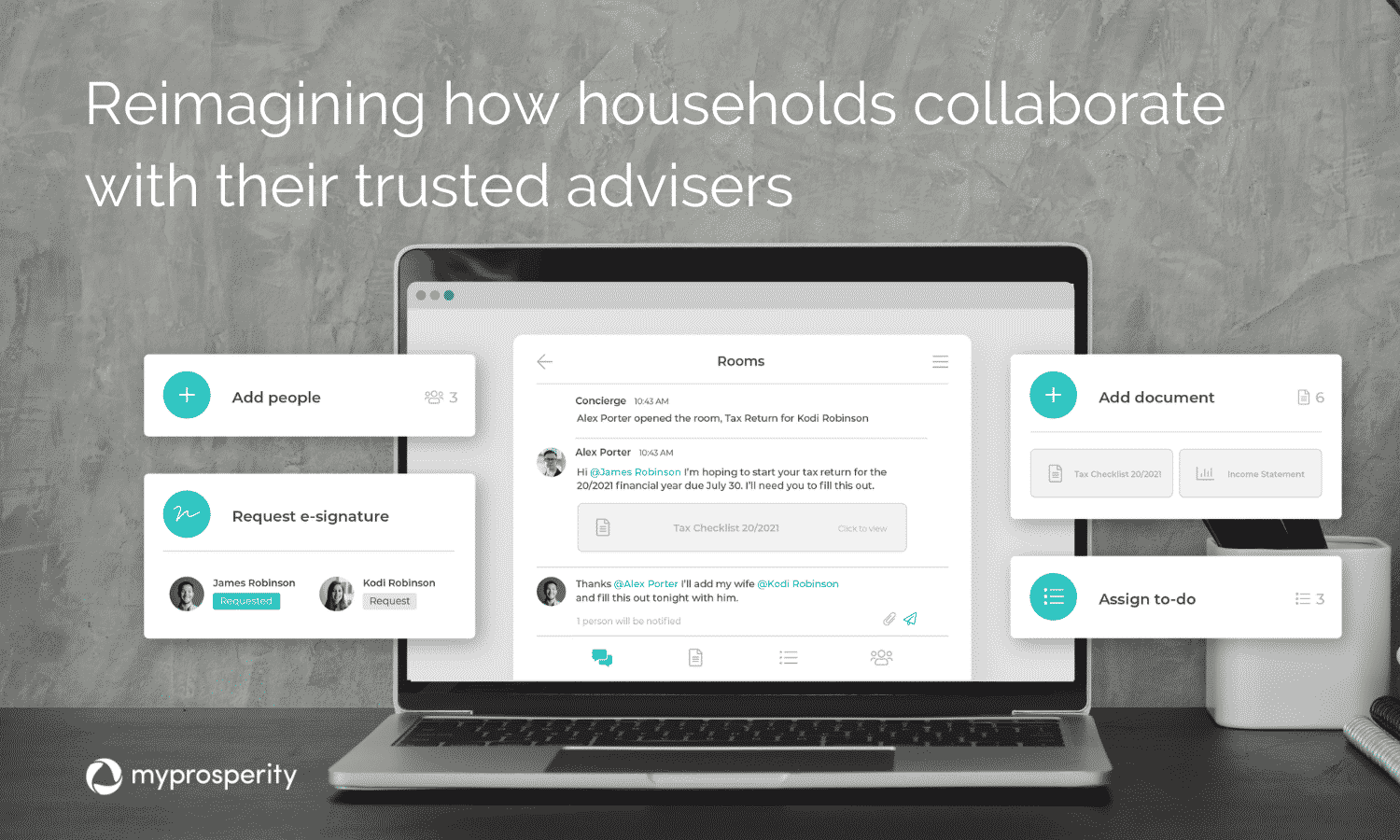

For Prashant, investing in technology like his branded wealth portal has really saved time and brought incredible efficiencies into his practice. “As soon as our clients sign off on the service agreement they are onboarded onto myprosperity and understand its a tool we are going to use with them on our journey together”. Prashant initially thought there may be some resistance from new clients to the portal, however, any concerns were easily answered and there is absolutely no pushback moving forward. “It’s all in your positioning and portraying trust with the client,” he says, adding, “The level of clarity and understanding that goes into a client is significantly higher and being able to have visibility of all of your finances and goals in one place is very powerful.” Prashant has had many clients provide positive feedback about his portal which has complimented his outstanding service and in turn has increased word of mouth referrals. “Having data at our fingertips means we can also be more proactive with clients.”

Reflecting on the last three years since Finnacle first began, Prashant mentions the biggest thing he has learnt is the division of labour and how much you should value your time. “As much as we can outsource back-office work, technology implemented properly can incrementally save you time and money,” he continues, “In particular, we could never deliver our services at our current price, without tools like myprosperity. In my opinion, most businesses will not be sustainable without technology. It’s a matter of ‘when’ not ‘if’.”

Recent Comments