In the last two months, the myprosperity app experienced a record number of mobile logins, expressing the demand clients have for on-the-go connection with their trusted accountant or adviser. In fact, 66% of all clients using myprosperity prefer to login on mobile over other devices. The future is mobile, and it’s taking off.

When Nokia launched the popular game “Snake” in 1997 it took the world by storm and was declared the “first mobile app”. It was simple, engaging, and anyone could easily learn how to play. Since then, mobile apps have undergone a rapid change in complexity and functionality, expanding from entertainment to inform, assist, connect and engage people across the globe.

Coupled with the introduction of the smartphone, we’ve seen mobile apps rapidly expand into every industry – including the financial sector. People expect their accountant or adviser to be across all channels, but especially mobile – because if I can order groceries, check into flights, make purchases and find love on my phone, why shouldn’t I also be able to access financial advice, view my cashflow and track my investments on there too?

Admittedly, it’s all very well to have an app for each of these tasks (or one that does it all) but this falls to the wayside if the app lacks a key ingredient – an engaging experience. Here are a couple ways to ensure your clients use your myprosperity mobile app effectively and find value in it;

1. Onboarding & Change Management

When using any new product or process there is a level of change management that needs to occur to move people from their current solution to the new solution. For our app this starts with onboarding new clients. myprosperity’s National Training Manager, Karen Kairouz, provided insight on the importance of onboarding your clients so they can use the app effectively. “There are a few things to consider when you introduce your clients to your mobile app for the first time.

- Explain the basic functionality of the app so your client can immediately understand the value that will be gained from engaging with you on this channel.

- Have a clear focus on what they will be using the app for initially e.g. Signing their tax return or completing a form like a fact find or tax checklist.

- Give clear guidance on how to use the app ongoing with you and by themselves – Whether it’s to upload documents, sign forms or communicate with instant chat. I suggest starting off with Rooms.

Be careful not to overwhelm your clients with too much information at once. Explain that when they use the app, they can use Rooms to collaborate with you on specific tasks such as tax planning. Finally, it’s important to review how your clients are engaging with your mobile app. What features are they using well? Which areas do they need help with? Research and develop education strategies and focussed communications around these areas to help grow and improve your mobile strategy whilst enhancing the client experience.”

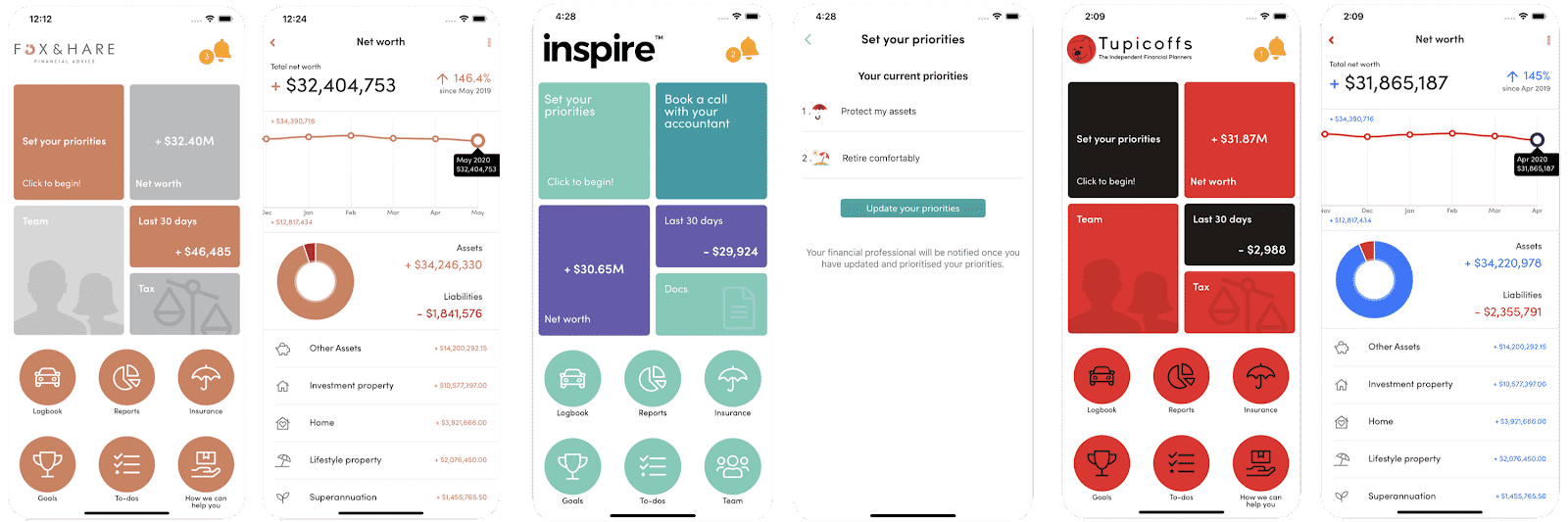

2. Personalisation

A report from McKinsey&Company revealed that mobile sales engagement for financial services can be increased by personalising your clients’ app experience. If we consider that an increase in user engagement leads to more opportunities to offer additional services, personalising your mobile app can observe up to 15 percent growth in revenue.

Customising your clients’ user experience can be done in numerous ways, but the most effective techniques revolve around your clients’ needs, demands and behaviours. Once you establish this, consider using personalised push notifications with relevant content or configuring your services so that clients aren’t sifting through solutions that are not meant for them. By putting the features and functions that are most relevant to your clients first, you can create a more engaging digital experience whilst streamlining your team’s workflow by getting forms filled in and eSignatures completed faster on mobile.

Director at Integral Private Wealth, David Simon commented on the transformation a branded app has brought to his practice, “We recently undertook to have myprosperity build our own branded app and we are delighted with the client engagement that it has delivered. The customer interface is impeccably clean and easy to navigate which makes for a far better client experience and helps to reinforce our brand as a digitally progressive advice firm,” he said.

3. Security

The number of mobile apps for banking, investment and financial services have skyrocketed since the 2010s, with 6 in 10 users preferring to complete their finance related tasks like checking investments via a mobile app. People worry less and less about cyber theft, with the introduction of Multi-Factor Authentication, Biosecurity and rigorous security audits. Security and privacy policies have become so substantial that we no longer blink an eye at the thought of using a mobile app to check an account balance or make a purchase.

A key focus for myprosperity is providing a platform that both our partner firms and their clients can trust. Therefore, we continue to invest in platform security to provide peace of mind. One element of this is maintaining our ISO 27001 certification, which verifies our platform across mobile and desktop at the global standard for data security and compliance.

4. Omnichannel presence

Having a presence across clients’ mobile, tablet and desktop screens means your clients won’t feel restricted to using just one channel to engage with you. In fact, a study from Invesp revealed that firms that employed an omnichannel digital presence retained 89% of their clients. Compare this to firms that used a single digital channel (i.e. desktop) to engage clients and retained only 33% – it’s clear to see that if you’re not on mobile, you’re nowhere.

If you’d like to know more about myprosperity’s mobile-first plans, book a demo today.

Josh Centner

Chief Product Officer at myprosperity

With a background in product innovation and agile management consulting for organisations such as IOOF, NAB, ANZ, PageUp and Xero, Josh brings over 13 years of knowledge in product innovation to the myprosperity team.

Recent Comments