Revenue: $10-20M

Clients: 2,000+

Staff: 41-60

Services: Wealth Creation, Taxation and Financial Reporting, Risk Protection, Banking & Finance, Superannuation Services (including SMSF) and Estate Planning

Tech Stack: myprosperity, Xero Practice Manager, XPlan, Salesforce, Class Super, Macquarie Wrap, BT Panorama, FeeSynergy & Zoom

Top 5 areas of focus in your business? Increase Revenue; Increase Efficiencies; Improved Client Engagement

After what has been an uncertain and tumultuous time in the financial planning sector, it’s understandable that many advisors would be somewhat cautious when it comes to looking ahead.

However, speaking with Daniel Stefanetti, Director and Partner at Grimsey Wealth, he’s optimistic about the future of our sector and the outlook for his firm which has grown to service 2000+ clients, employ about 60 people and open offices in both Sydney and Melbourne.

“Our focus right now is definitely on growth. Whilst the economy is going through tough times and there is a lot of pessimism about this period of low interest rates, with the right advice there is an enormous amount of wealth that we can create for our clients over the next two decades.”

Specialising in creating wealth for clients in the medical profession, the team at Grimsey has recently focused on deploying technology to establish practice efficiencies that streamline compliance and administrative tasks. Of late that focus has shifted to scaling the advice business to maximise growth opportunities. Grimsey was one of the early advice firms to move to myprosperity and over the past year the strategic importance of the software platform has been elevated to underpin their plans for growth.

“myprosperity is now the single most critical technology platform in our business to achieve growth and our strategy is to have 100% of clients using it” Stefanetti said, adding his team uses the wealth platform to onboard clients and ensure advisers receive updates on all assets and liabilities.

Previously, advisers would use spreadsheets to achieve this and would continually have to revisit these to keep information updated.

“Often a client would sell a property or pay down debt and we wouldn’t know about it. myprosperity allows us to know what is happening in their financial world, which is critical for us in demonstrating that we actually know our customer.”

Daniel recalls how previously he would have a 40 minute meeting with clients and spend most of it capturing and filling out data.

“Clients don’t want us to waste their time or ours. So, our stance today is that software must do the heavy lifting and give us back time to do what our clients want.”

In recent months Grimsey has started using the digital forms feature in myprosperity to provide clients with an online tax checklist. Grimsey now have approximately one-third of their client base using this checklist and have mandated its use across all their accountants and clients. The result has meant that about 90% of the data profiled against each client is captured once and does not have to be re-entered elsewhere through the client engagement process.

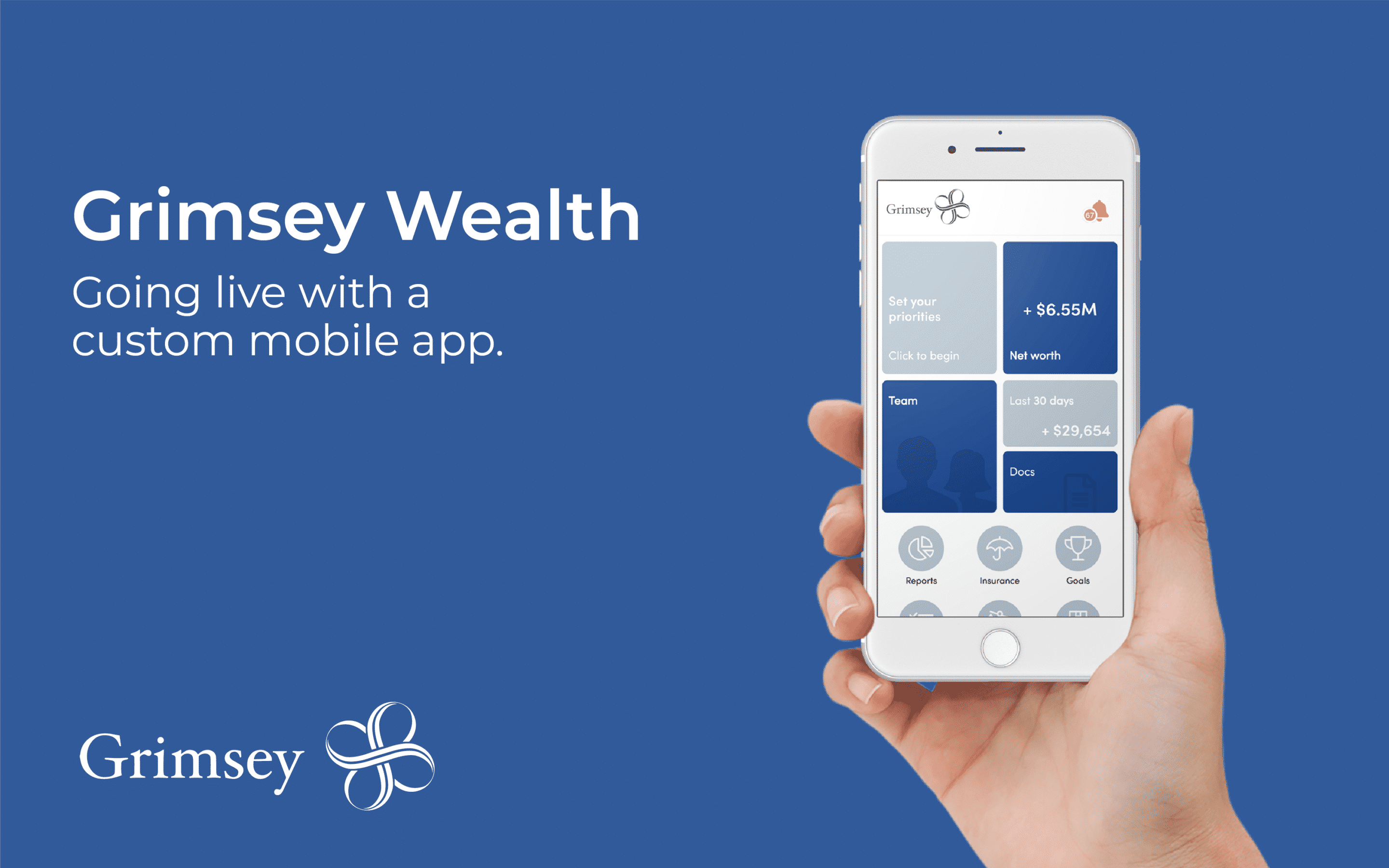

Grimsey is also actively rolling out digital document signing, a feature of the myprosperity platform that will help deliver further efficiencies to their advisers and clients they serve. Given the mobile nature of their largely medical client base, Grimsey has recently introduced its own branded myprosperity mobile app for the convenience of all clients to access their wealth portal on the move. For Stefanetti, this amplifies the digital experience that is so important for servicing their clients, particularly the younger cohorts who expect this type of capability from their advisers.

“As we embrace the whole shift to digital advice, we need to ensure we can arm our advisers with the technology that delivers a great experience, including mobile. Our business is advice, so we need to partner with the right technology providers to help us do what we do best. myprosperity is a big part of enabling us to do just that.”

Recent Comments