In 2014 when I was running Xero in Australia, I recall a rather prophetic article that quoted Mike Cannon-Brookes of Atlassion fame, along with reknowned tech investor and Seek co-founder, Paul Bassat regarding the blossoming fintech industry. Cannon-brookes, no stranger to disruption and innovation took great delight in declaring war on the Big 4 banks and describing their $29B of profits that they disclosed that year as “insane” and fair game for new fintech players. Since then the fintech industry has burgeoned with well over a thousand local fintechs vying to bring innovation, new capability and disruption to the financial services industry and take a slice of those profits.

One of those categories within the fintech industry is the so-called neo banks. The likes of Judo, Xinja, Volt, Up and 86400 (denoting the number of seconds there are in a day) have come to the fore over the past few years vowing to take a huge chunk of the retail banking market by attracting a younger and more tech savvy cohort of consumers to their mobile online bank offering. However, in late 2020 it was announced that Xinja was handing back it’s banking licence and returning more than $252M back to its nearly 40,000 customers. Then last week, we learned that Nab had approved $220 million to acquire 86400 to leverage the technology they had built in order to accelerate the growth of their UBank business. So it begs the question, are the neo banks really what they were cracked up to be? And would you recommend them to your clients?

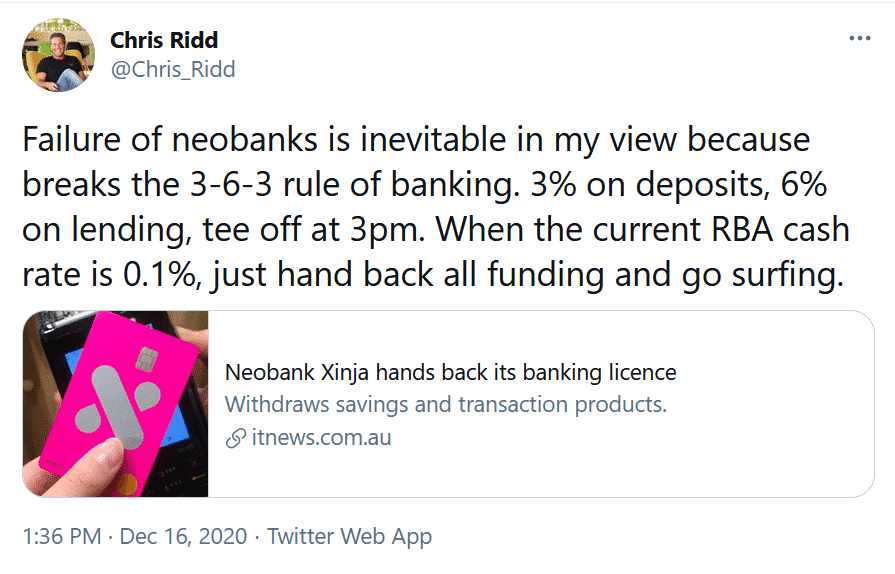

Last week, I was approached by Simon Thomsen, Editor in Chief at Startup Daily to comment on this latest development with 86400. A month earlier, he had noted a cheeky remark that I had made on Twitter regarding the demise of Xinja.

And so I guess that made me an instant expert to comment on the plight of the neobank movement? 🙂 And to unpack the unfolding drama that lies ahead for this seemingly unchallenged category within the large fintech landscape. You can watch the full interview on Ausbiz here. By the way, my tweet was simply remarking on the thin margins that any bank is currently experiencing given that the RBA cash rate is so low. I also wonder whether the rise of neobanks was largely driven off the back of growing public dissatisfaction with the Big 4 banks and not just a better tech-enabled user experience.

Most of the banks continue to invest heavily in technology and particularly in mobile, and one could argue that their handling of the COVID crisis post Royal Commission has started to rebuild some of the consumer confidence in banks that was eroded over previous years and a string of high profile scandals.

A recent report by PWC into the future of retail banking would tend to support my assessment. Check it out here. Whilst new players, improved technology and alternative channels will continue to evolve out of the fintech revolution, the Big Banks are unlikely to go away. And competition won’t necessarily come from the startup and VC funded neobank challengers. It is going to be Bigtech such as Facebook, Google, Apple and Amazon, all of whom have deep pockets, enormous global scale and low customer acquisition costs that allow them to launch adjacent financial services and offer them to an enormous customer base of consumers.

My comments in the interview with Startup Daily about myprosperity reflected the fact that we are not competing with banks and in fact, have identified whitespace in supporting the digital engagement between advisor and client. That is a big gap today and one that the banks are unable to plug, and at a time when they are all getting out of wealth management.

Our offering was built on the understanding that consumers will not only use multiple banks, but their investments, superannuation, insurance and many other financial products will need to be accessible in one place to enable a consolidated view of their financial position. So regardless of the emerging banks, neobanks or any other new wizz bang financial services offering that your clients choose to go with, we will continue to integrate with all of them. This gives you and your clients access to critical data to make collection seamless and in real time, and ultimately enable you, the advisor, to deliver data-driven and more timely advice.

Recent Comments