Earlier this week the controversial reforms that the Federal Government has been pushing for, with understandably strong support from the banks, have been postponed. The reforms would have seen Australia’s responsible lending laws overhauled but will now await passage through the Senate in the next round of sittings in May.

These reforms are designed to fundamentally change how responsible lending obligations work in Australia, reversing the post-Global Financial Crisis requirement for lenders needing to properly vet borrowers. Understandably, this proposal has been met with enormous criticism from opposition parties and consumer groups. They argue that the reforms are at odds with recommendations from the Hayne Royal Commission to protect consumers, particularly in situations where less financially literate people are placed into loans that they cannot afford.

Interestingly, the reforms also cover provisions to extend Best Interest Duty (BID) beyond just mortgage brokers to cover all consumer-facing brokers. BID is a series of legislative obligations regulated by ASIC, and stipulates that financial planners and mortgage brokers must always act in the best interests of their customers in the provision of their services, and avoid conflicts of interest when recommending financial products.

In actual fact, BID requires that advisers and brokers increase their reporting, research and justification of the actions and advice they give. This means that they need to undertake adequate research to gain a thorough understanding of their client’s situation and needs before recommending products. So, regardless of whether you support the paring back of the legislation or not, the fact remains that as a financial planner or mortgage broker dealing with clients and advising on lending, Best Interest Duty still applies. Which means you need to have done adequate due diligence before advising a client that they can borrow or extend debt.

This is where technology can play a vital role and is often overlooked. I noted a great interview in which myprosperity’s, Karolina Kuszyk spoke with Nathan Fradley of Lime Financial about his use of technology to support this very important aspect of his advisory firm. You can watch the interview here.

Nathan spoke about how he first took on myprosperity 4 years earlier and was expecting that it would be a “magical budgeting tool that would help with my clients’ cash flow and budgeting challenges”. In actual fact, he no longer views myprosperity as a budgeting tool but rather a comprehensive platform that underpins how he engages with clients on just about every interaction, from onboarding, gathering data and signing documents.

On the cash flow and budgeting front, he now views that feature more as a compliance tool. In the interview, he spoke about his obligation under FASEA to really understand his clients. “How do I get proof or evidence of what they spend? We can’t just accept what they have told us.” He went on to say, “Clients can give you a fantastic Excel spreadsheet budget, but is it real?”. Nathan spoke about how in the past he would validate spending patterns and determine discretionary spend by trawling through bank statements in an effort to evidence the real situation. “What I have found is that myprosperity is an absolute godsend. New clients are put onto myprosperity and amongst various actions to assess their financial position, bank data is pulled into the cash flow tool, so that discretionary spend can be assessed without any manual effort.”

Nathan makes an important point about how to use technology to do the heavy lifting. As we’ve learned through hundreds of advisers and accountants, detailed cash flow and budgeting management for clients is often a real challenge to execute profitably, so they’re seeking out tools primarily to validate cash in and out, and identify trends to help clients better manage their money.

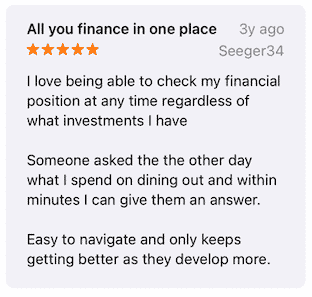

From a client standpoint, and I know from my own experience, that rather than trying to manage my money down to every dollar earned and spent, the ability to auto categorise spending to see where money is going is something that I was never able to do before myprosperity. I think the following client review on myprosperity that was posted a few years ago on the Apple AppStore sums up the value of this feature for clients using myprosperity.

Author: Chris Ridd

Recent Comments